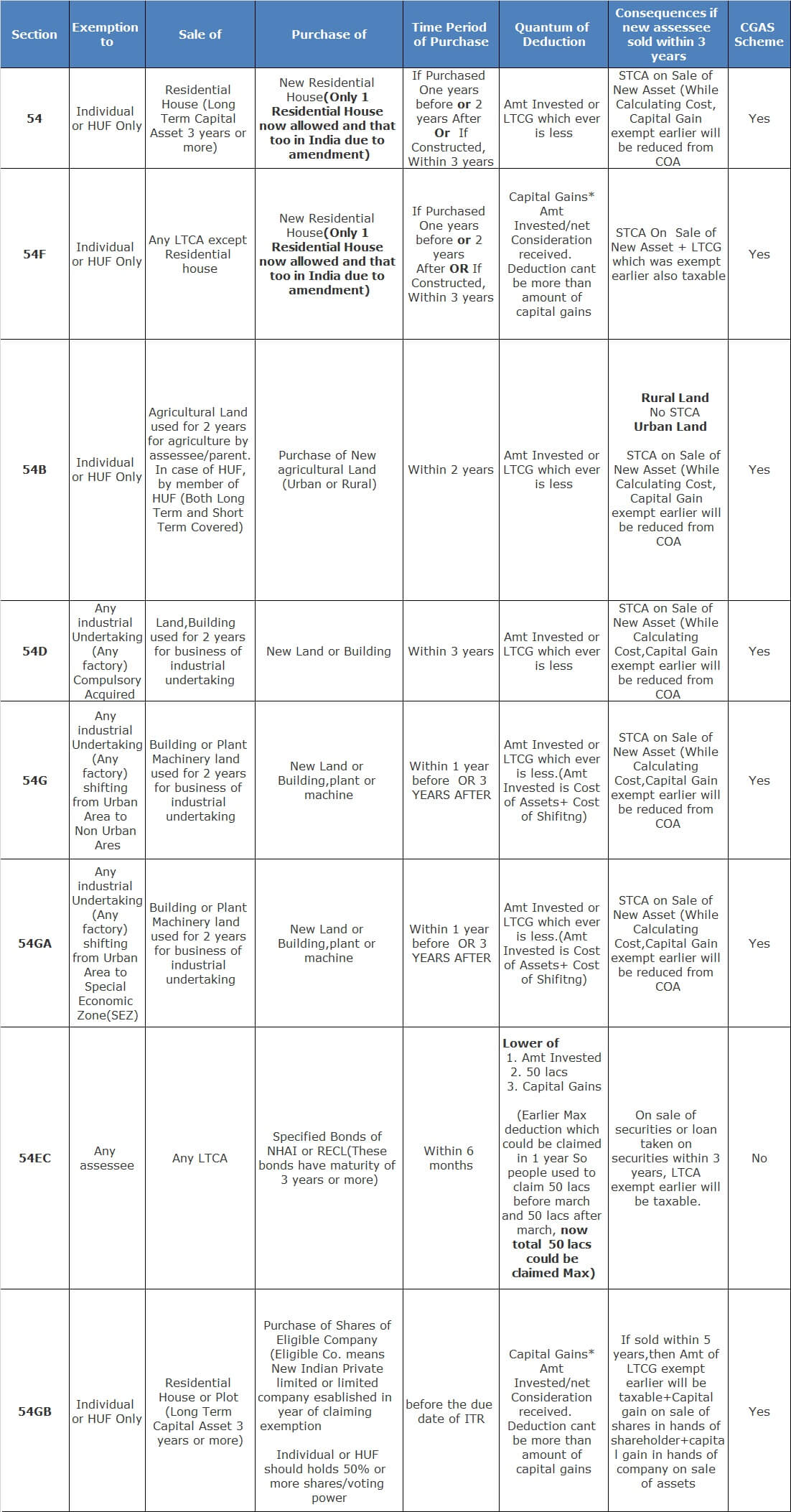

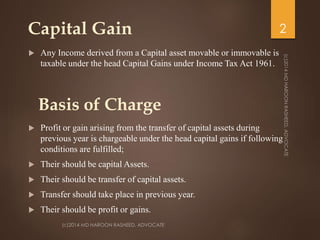

Buy Taxmann's Taxation of Capital Gains – In-depth, thorough & chapter-wise analysis of each aspect of capital gains with the help of case laws, illustrations and case studies | Finance Act 2023

Capital Gains cannot be Taxable when Transfer of Land Taken Place in Previous Year of Assessment proceedings : ITAT

Deduction u/s 54 of Income Tax Act not allowable as Capital Gain as is not Taxable in Current Assessment Year: ITAT directs to examine Previous A.Y.

:max_bytes(150000):strip_icc()/over-55-home-sale-exemption2-46c8496917a1458b8583b6e8b8bc3800.jpg)

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)