Thomas R. Ittelson Quote: “Book Value Book value represents the value at which assets are carried on the “books” of the company. The book value of ...”

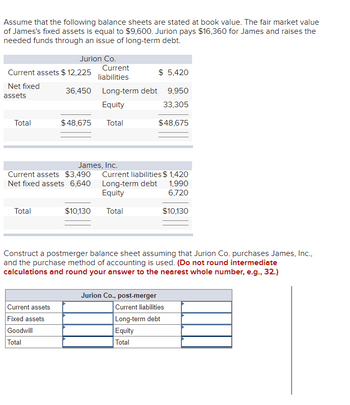

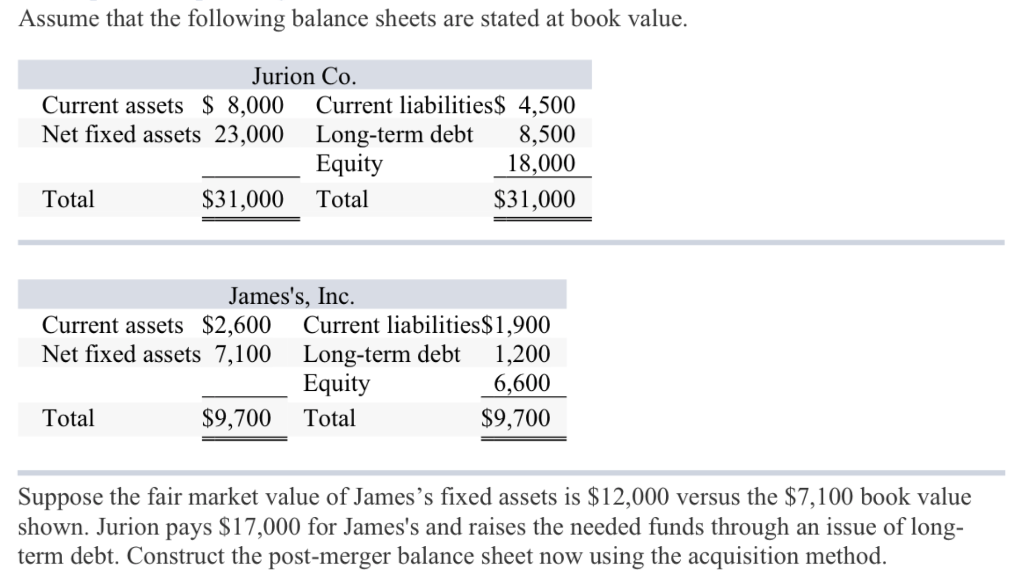

Solved! Market Value Capital Structure Suppose the Schoof Company has this book value balance sheet: $20,000,000 $10,000,000 30,000,000 1,000,000 39,000,000 $100,000,000 Current assets $30,000,000 Current liabilities Notes payable Long-term debt

Key Concepts & Skills Calculate & explain A firm's cost of common equity capital A firm's cost of preferred stock A firm's cost of debt A firm's overall. - ppt download

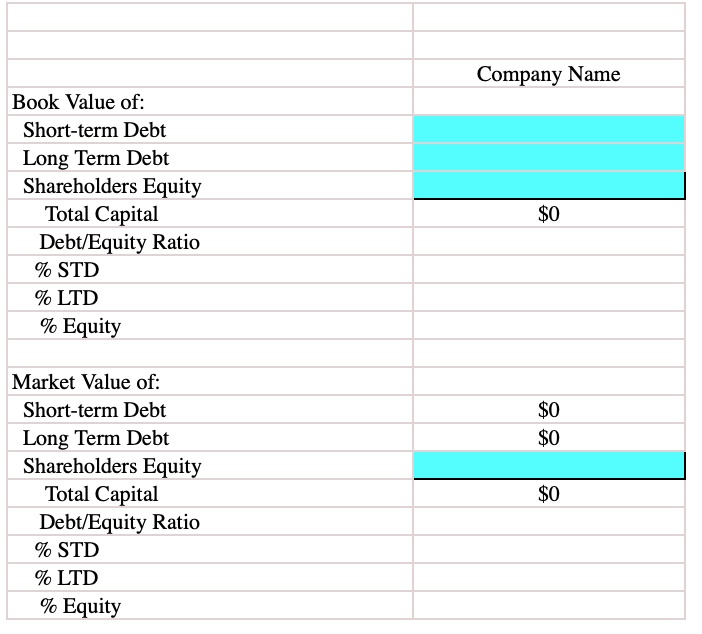

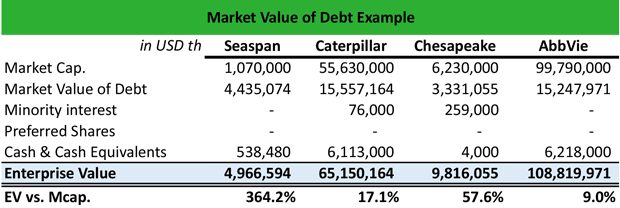

SOLVED: Capital structure is the mix of debt and equity used to finance a firm's assets. Information on a firm's financial statements, but the value of the debt and the value of

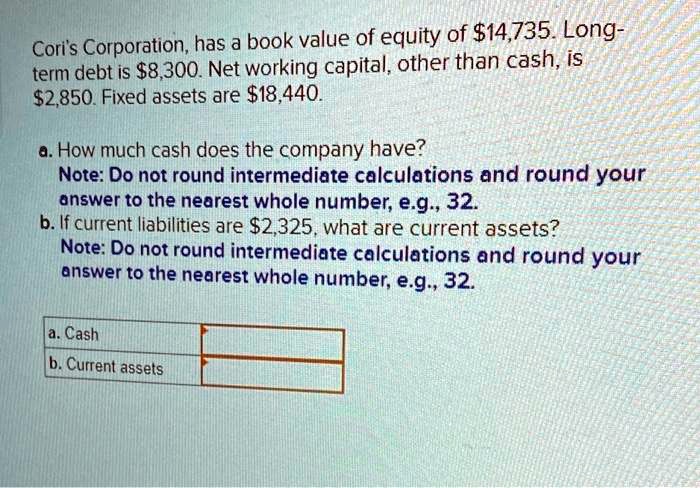

SOLVED: Cori's Corporation has a book value of equity of 14,735. Long-term debt is8,300. Net working capital, other than cash, is 2,850. Fixed assets are18,440. a. How much cash does the company

:max_bytes(150000):strip_icc()/book-value-99796d4d1fb44bd4bdc961e6042698d7.jpg)

:max_bytes(150000):strip_icc()/price-to-book-ratio-bf64b6abed4d4d2292f3ab58bd55ed36.png)